Dear Friends and Clients: This morning, President Trump signed the most sweeping tax legislation since the tax reform act of 1986. While we will be working hard to dissect this new tax legislation over the coming weeks, I wanted to provide you with some "tax stocking stuffers" to start thinking about this over the weekend because there are tax saving opportunities to take advantage of before the end of 2017. Even though the tax legislation does not come into play until the 2018 tax year, Taxpayers should be mindful that the shift in tax laws from 2017 to 2018 may provide opportunities to lower…

2017 Tax Planning in the Trump Era of Tax Reform

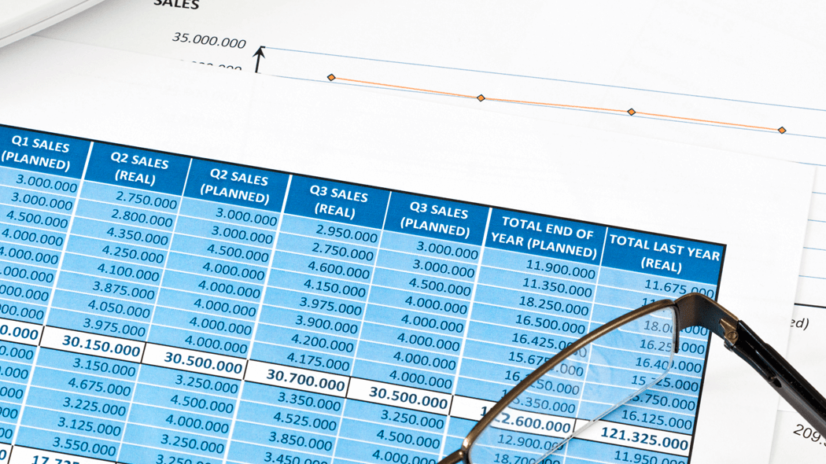

As we make our final approach towards closing out the tax year, business owners should be mindful of their business performance even more so due to the impending changes to our tax laws. Both President Trump and the Senate have proposed their own versions of plans to overhaul our tax system. While both make radical claims to reduce taxes for all, they appear to do little more than lower the tax rates at the expense of eliminating many deductions that business owners, the wealthy, and even the middle class rely on to lower their tax bills. This article does not go…

Tax Alert: Californians May Now Face Income Tax Rates Greater Than 50%

MinowCPA Guide to Effective Tax Planning in 2013 Dear Clients and Friends: In 2013, the Internal Revenue Service (IRS) and California Franchise Tax Board (FTB) increased the income tax brackets. The highest income earners now face a 39.6% federal marginal income tax rate. In addition, the IRS layered on two additional taxes for higher income earners, including a tax on Net Investment Income (NII) of 3.8% and a Medicare tax on wages and self-employment earnings of 0.9%. California also increased its marginal income tax rate up to 10.3% for the highest earners. Thus, the combined Federal and State marginal income…